When a health insurance company refuses to pay for treatment, most people begrudgingly accept the decision.

Few patients appeal; some don’t trust the insurer to reverse its own decision.

But a little-known process that requires insurers and plans to seek an independent opinion outside their walls can force insurers to pay for what can be lifesaving treatment. External reviews are one of the industry’s best-kept secrets, and only a tiny fraction of those eligible actually use them.

ProPublica recently reported the story of a North Carolina couple, Teressa Sutton-Schulman and her husband, who we identified in the story by his middle initial, L, to protect his privacy. Last year, L suffered escalating mental health issues and needed intensive psychiatric care. Highmark Blue Cross Blue Shield issued the couple multiple denials in their case, even after Sutton-Schulman’s husband attempted suicide twice in the span of 11 days.

The instructions for an external review were buried on page seven of one of the denial letters.

“You can now request that your case be reviewed by a health care provider who is totally independent of your health plan or insurance carrier,” read the letter from the state insurance department in Texas, where the treatment occurred.

Skeptical but hopeful, Sutton-Schulman submitted the request for the external review. Their case was assigned to Dr. Neal Goldenberg, an Ohio doctor who works for a third-party review company as a side job. After reading the extensive appeal, Goldenberg overturned Highmark’s denial to cover treatment that had cost Sutton-Schulman and L more than $70,000.

Highmark previously said in a statement that the company was “passionate about providing appropriate and timely care” to its members. It acknowledged that “small errors made by physicians and/or members can lead to delays and initial denials” but said that those are corrected on appeals.

The lesson is simple, explained Kaye Pestaina, a vice president at the nonprofit health policy think tank KFF, who has studied external appeals.

“Appeal, appeal, appeal, appeal,” she said. “That’s all you have.”

External appeals have been around for decades at the state level, but in 2010, the Affordable Care Act expanded access to the reviews for the majority of people who get their health insurance through work. The details around the external review process vary depending on whether an insurance plan is regulated by state or federal laws.

Karen Pollitz helped draft the federal regulations around external reviews during the Obama administration, but she said an extensive lobbying effort on behalf of insurance companies and employers weakened the initial protections. Now, only a fraction of denials are eligible for an external review, and the health insurance plan gets to hire the reviewers.

Transparency requirements that called for insurers to report data around denials and other metrics, she said, also were largely not implemented.

“There are all kinds of ways they could strengthen the laws and the regulations to hold health plans more accountable,” said Pollitz, who left the administration after the rollbacks and worked at KFF before retiring.

But for now, Pollitz said, filing external appeals is sometimes the only recourse patients have. An advantage of the Affordable Care Act, she added, was that it established state consumer assistance programs to help people get the coverage they were promised.

Federal funding for those programs dried up a couple of years later, but about 30 states decided to find other ways to pay for the programs. (Want to find out if your state has one? Here’s a list from federal officials.) If the remaining 20 or so states — including Wisconsin and Ohio — established programs, families would reap the benefits, according to Cheryl Fish-Parcham, director of private coverage at the consumer health care advocacy organization Families USA.

“Every state needs one of these programs,” she said. “Health care is so complicated, and people really need experts to turn to.”

Fish-Parcham meets with representatives from consumer assistance programs across the country every month. The models differ from state to state. Programs are housed in state attorney general offices, in nonprofits and even as independent agencies. Helping patients or their providers with external appeals is a key part of the programs’ role. The first step often is simply letting them know that appeals — both internal and external — are options.

“The numbers are low because some people just give up. They’re frustrated. They’re tired. They’re battling cancer,” said Kimberly Cammarata, director of Maryland’s Health Education and Advocacy Unit, the state’s consumer assistance program. “And sometimes the information about why the claim was denied or about how to appeal is terribly unclear. A lot of these outcome letters will say you have a right to an external appeal, but they don’t exactly tell you where to go.”

Some states have enacted legislation to combat that confusion. For example, insurers in Maryland are no longer able to bury information on appeals deep in their denial letters. Beginning this month, a new state law requires insurers to include information at the top of all denial letters in “prominent bold print” that states the member has the right to appeal or file a complaint to the insurance commissioner. That declaration advises consumers that the letter contains information on how to file an appeal and reach the Health Education and Advocacy Unit. The unit’s address, phone number, fax and email must also be included in the body of the notice.

Connecticut added similar information at the top of denial letters in a box on the front page in 2023. The office saw an almost immediate effect. In the two years that followed, more than 40% of referrals to the state’s Office of the Healthcare Advocate came from people who received denial letters with the new language.

The office isn’t funded through taxpayer money. It’s paid for entirely by state assessments on insurance companies.

“We want to help people,” said Kathleen Holt, who was nominated in 2024 by Connecticut’s governor to lead the office as the state health care advocate. “The insurance companies know that people don’t appeal, and in some ways I think they can be more aggressive with their denials. They don’t expect people to come back, and when they do that very small percentage of the time, it’s the cost of doing business for them.”

Connecticut’s data shows that the health care advocate office has been able to resolve or overturn denials in the patient’s favor about 80% of the time, Holt said. Some plans may charge up to $25 per external appeal, but Connecticut did away with that fee several years ago. Some states, including New York, have been tracking the outcomes of their external appeals online, which the public can review.

“We can help people write their appeals,” Elisabeth Benjamin, vice president of health initiatives at the Community Service Society, said of New York residents. “We write appeals for them, sometimes going through thousands of pages of medical records and writing 15- to 20-page appeals.”

Experts say these six things can help patients and providers after a denial. Since we are journalists and not lawyers, we are unable to provide any legal advice about this process.

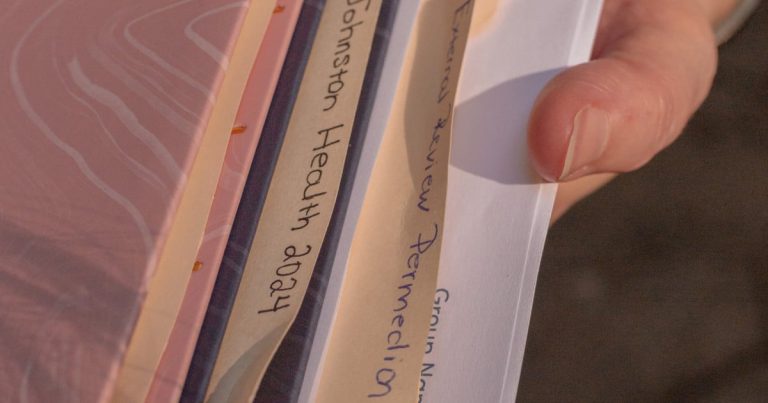

- Gather your information: Experts suggest not throwing out any letters or notices from your insurer, including denial notices, explanation of benefits, correspondence and plan documents. If you’ve misplaced them, they said you can contact your insurer for additional copies. They also recommend downloading or requesting your medical records. You can request your claim file, which most people have a right to under federal regulations.

- Does your state have a consumer assistance program? Not all states have consumer assistance programs. Here’s a list of those that do. Advocates recommend reaching out and asking them to explain the denial. It might be as simple as a missing or incorrect code. Their job is to use their time, experience and resources to explain the process. Their services are free. Other programs and nonprofits also offer assistance.

- Why were you denied, and what are your timelines to appeal? Are you being denied because the insurer determined the treatment was not medically necessary or because your plan didn’t cover it? Does your plan follow federal or state regulations? Experts say these distinctions may determine if and how you appeal your denial. Most plans give you about 180 days from the date of the denial notice to appeal internally, but experts say not to wait. If you’re not sure about the answers to any of these questions, you can call your insurer and ask. They are required to provide you the reason for denial.

- Can your health care provider help? Experts suggest reaching out to your doctor or therapist. They said some providers will file the appeal on your behalf. Others will write a letter of support. At the very least, advocates agree, most should help you understand why your treatment was denied and what additional steps you can take.

- Filing an internal appeal: Before you can file an external appeal, you typically have to attempt to resolve the dispute internally with the insurance company. This step may involve one or two levels of internal appeals.

- How to request an external appeal: This is your last shot before considering a lawsuit. After you’ve exhausted your internal appeals, you can contact your insurer to request an external appeal. When you file a request for a federal external review, your plan usually has five days to consider your request.

If the insurer agrees that your denial is eligible, it will provide directions on where to file the appeal. Experts say to make sure to read the notice all the way through.

Remember that only certain denials are eligible for external appeals. These denials typically involve medical judgment, surprise medical bills, or an insurer deciding to retroactively cancel coverage or determining that a treatment was experimental. Denials based on the terms of the plan or because the service was out of network generally are not eligible.

Under federal rules, third-party review companies typically have between 45 and 60 days to decide the outcome of an external review. You may ask for an expedited appeal if the situation is urgent. In those situations, you may also be eligible to request an external review without exhausting your internal appeals or even file both internal and external appeals at the same time. Federal requirements typically call for expedited external appeals to occur as quickly as your condition requires but not take longer than 72 hours.

If the external reviewer decides to overturn your denial, the determination is binding. Your insurer is required by law to accept the decision and pay for treatment. If the reviewer rules against you, you may be able to file a lawsuit.