After working hard to join her family’s primary care practice, the pandemic threw a wrench in Andrea’s plans. As she explains, “I had just come back to work with my dad. He has his own practice, and I’m thinking, I’m going to be making $200,000. But what really took me under was when Covid hit. Private practice went downhill, and I bought this house that had an underground oil tank that failed.”

When Andrea couldn’t keep up with the mortgage, she decided the only solution was to sell her beloved home. But first, she needed to fix the oil tank for a whopping $20,000, which she added to her existing credit card debt. After her first offer fell through, the pandemic put people looking to move on hold.

Andrea reached her limit when, “The season came, and I had to decide if I was going to do a Christmas for the kids and get gifts or if I was gonna struggle to make these minimal payments. I chose my kids,” explains Andrea. When she was no longer capable of making even the minimum payments on her credit card, Andrea turned to National Debt Relief for help.

Feelings of shame

Having that financial burden also disrupted her emotionally. According to Andrea, “I feel like I set the bar very high on what we needed financially. It caused disruption between my spouse and I because we couldn’t enjoy life. And I think this situation created a big test in our relationship because we’re pulling our hairs as to how we are gonna live. How we’re gonna function and meet everybody’s necessities.”

People assumed that being a doctor meant she was well off, and she was okay financially, mentally, and physically. This added stress to an already impossible situation.

Andrea cautions, “That’s the dangerous part because you never know the situation that somebody else is going under. It feels like one of the most shameful positions to be in, even though you’ve done so many amazing things for yourself. Any one of us could really end up in the same place. It doesn’t matter. We all assume things about one another because of profession, because of where we live. But ultimately, we’re all in the same boat.”

Giving it a go

One of Andrea’s brothers recommended National Debt Relief while going through a similar situation. But Andrea wasn’t ready to give it a go until she was forced to make that difficult decision at Christmas. “When I hit the wall, I called.

I’m having a real conversation, and my rep is asking me questions about my goals and where I stand,” says Andrea. She immediately felt relief, especially when her rep assured her that she wasn’t the only one in debt. What was important was that Andrea was ready to tackle her debt and take back control of her life.

As Andrea explains, “She gave me the general gist of how the program works and how there would always be somebody reaching out to me. And then sure enough, there was always somebody to make sure that I was okay, and if I had any needs along the way.”

Following the process, making progress

Initially, Andrea found it daunting to speak with someone she assumed didn’t care. She was pleasantly surprised when she saw that her National Debt Relief rep was truly immersed in helping her resolve her debt. “Being able to trust them to do their job and to help you, it allows you to take care of what’s important in your life,” exclaims Andrea. Andrea described her experience at NDR as a process. “At some point you’re sitting back and allowing it to happen. I did get to the point where I was comfortable and I’m seeing that there’s progress.

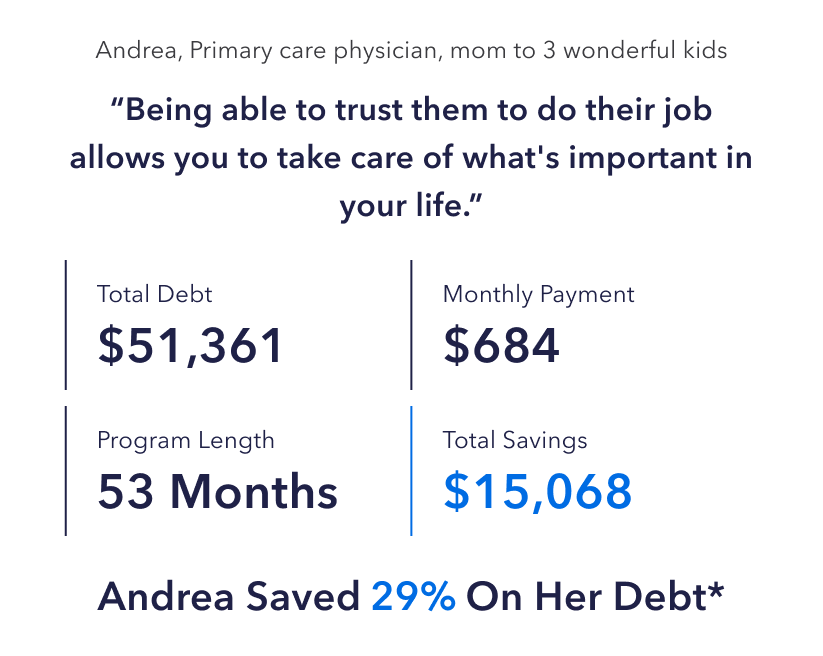

Then I just got a call one day and they said, ‘This is where we take care of the debt, and you’re almost there. This is where you’re gonna see those credits have all resolved.’ And sure enough, that’s when everything just starts lifting off. I remember a $16,000 debt, and the settlement was less than $8,000*. It was really significant.

That was a moment where I’m thinking there’s other opportunities that are gonna open up for me, whether it’s to refinance my house, whether it’s to buy another car that we really need, or to even get furniture. It really started to open up this whole new life. And that was the moment that I realized I could breathe.”

Honoring trueness

Through teary eyes, Andrea sang her praises for NDR. “The people that you work with all seem to have that heart. That’s what makes NDR stronger. Reaching this joyous moment is sort of that culmination of all the hard work that you’ve put in. It’s just a big thank you, not just for providing that service, but for having such wonderful humans working under you and really instilling that energy, that realness in your environment.”

She expressed disbelief in finding a company that truly cared. Andrea explains, “In my line of job, I work with my heart and of course, there are people that don’t. So, just honoring trueness and love and ethics, I appreciate that. And I feel like that’s rare. And I think that’s what helps NDR not only be successful but help us all be successful.”

Moving forward

Now that Andrea has the financial freedom to move forward with her life, she and her family are now able to enjoy their home instead of struggling to afford it. Her relationship with her husband is better than ever. And she’s thrilled to provide her kids with the life she feels they deserve.

Grateful is a feeling that Andrea expressed often when describing NDR. “Thank you. I’m finally able to do stuff. For example, we’re going to the Poconos this weekend. The kids, I can put them in classes now. They can take swim classes and dance classes. I can finally pay for their school.”

Let the people at National Debt Relief help you write your success story. We have supported over 500,000 people nationwide every step of the way to help them resolve their debt, regain financial independence, and adjust their spending habits to remain debt free.

*savings on account with fees